Our Blog

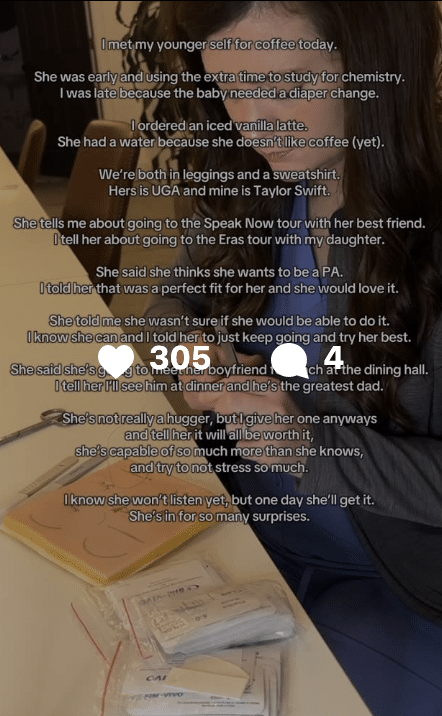

Explore tips, strategies, and real stories to help you navigate your journey to PA school with confidence.

Blog Categories

Get Support, Strategy, and Success in Group Coaching

Join our Pre-PA Academy and gain access to group coaching sessions designed to guide you through every step of your PA school journey—from planning to acceptance.

Start With the Content Students Trust Most

Get expert guidance every step of the way. From podcast episodes and YouTube videos to blog posts and downloadable templates, everything we create is designed to make your Pre-PA journey easier, smarter, and more successful.